Intrinsic and Extrinsic value of Options

Option Education 1

Introduction:

Welcome to our first Option Education article. People that are just getting started with options trading sometimes have a difficulty understanding the basics, which can lead to significant losses. In this series we will talk about everything related to options and increase the difficulty along the way.

Let’s get started.

Intrinsic Value

What is intrinsic value and what does it mean for an option?

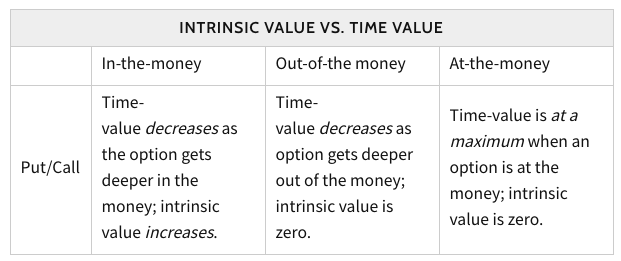

First and foremost it is important to know that only options that are IN the money (ITM) have INtrinsic value. Thus, it is of crucial importance to know when an option is or isn’t in the money.

Once we know if an option is ITM, we can easily calculated the intrinsic value of this option.

For a call option this is: “the price of the underlying asset” – “the strike price of the option”

For a put option this is: “the strike price of the option” – “the price of the underlying asset”

Options At the money (ATM) and options Out of the money (OTM) have NO intrinsic value

If we take a call option that is OTM. A call option with strike price 20, while the price is 15, for example. If we calculate the intrinsic value. 15 – 20 = -5. Intrinsic value can never be a negative number. So the intrinsic value for a call option OTM is 0.

The share rises from 15 to 20. The call option with strike price 20 is now ATM. We calculate the intrinsic value. 20 – 20 = 0. ATM call options also have no intrinsic value.

If the stock rises above 20, which is the call option's strike price. Only then will the call option carry intrinsic value. With a price at 21, the call option will have 1 (21 – 20) intrinsic value. If the price is at 27.50, the call option will carry 7.50 (27.50 – 20) intrinsic value.

A good table to study if u struggle with this concept is the following:

The same concept counts for put options

Price of an option compared to its intrinsic value

Once we know how to calculate the intrinsic value of an option, we can compare the option with its intrinsic value. After u have read all of the above u should be able to do this. Whether an option has intrinsic value depends on its '“moneyness”. Moneyness just means if an option is ITM, ATM or OTM. If you are struggling with understanding the concept of moneyness feel free to message us and we might post an article talking about the moneyness if there is enough interest for it.

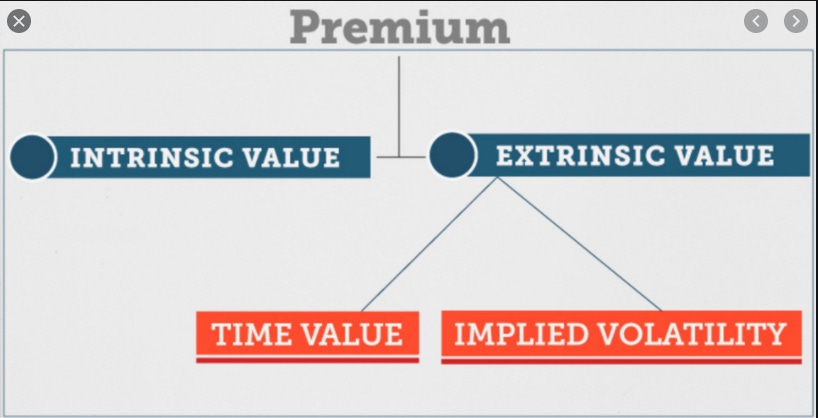

Option Pricing thus consists of Intrinsic Value + Extrinsic Value. Whatever an option is worth more than its intrinsic value we call extrinsic value.

How an option’s extrinsic value gets calculated we will talk about further in later articles as this is a lot more difficult. Later on we will talk about “time” (also seen as DTE) and “risk” (which can be seen through Implied Volatility). These will play the main role in the extrensic value calculation.

We know that options that are ATM and OTM have no intrinsic value. So if these still have value, then this value is purely extrinsic value. There are many synonyms for the term “extrinsic value” that are used inappropriately. Since this “extrinsic value” is made up of 2 components (time and risk) and we still want to define it with 1 word, confusion can arise. Synonyms are: Time value, hope value, time credit, risk premium.

Preliminary conclusion

The most important things we want to remember of this piece are:

We know how to calculate the "intrinsic value" of an option. In addition, what an option is worth more in value than its intrinsic value, that is what we call “extrinsic value” (or 1 of the many synonyms we know for that). “Time value” is the term I use the most. Extrinsic value is therefore also strongly – if not completely – linked to time (DTE) and risk (implied volatility).

Intrinsic value (at expiration)

To understand intrinsic value even better, we must also look at what “intrinsic value at expiration” means. After all, on expiration, the time factor (DTE) is reduced to 0. The “extrinsic value” of an option will then inevitably also have disappeared. The time factor no longer matters. And since risk is something that can play out over time, there is no longer a risk factor that plays an important role.

When options expire, the “strike price of the option” and the “price of the underlying asset at closing” (closing price) are therefore taken into account. Furthermore, this will determine whether an option still had intrinsic value or not. It is this intrinsic value that will determine whether an option contract will still have value on expiration, or not.

The exercise here is relatively simple. If we bought a call option (i.e. a right to buy shares) at a certain pre-agreed price (the strike price), our contract will only have value if we can buy those shares at a price lower than the closing price of that share.

A right to buy shares at 30, while the closing price is 35. Will be worth 5. If the stock closes at 32, then that right to buy is worth 2. If the stock closes at 30 (ATM) or lower (OTM), then the option will expire without intrinsic value, and therefore be worthless. Because “the time and risk component” (extrinsic value) are also reduced to zero at that moment. Furthermore, who would want to buy shares through the call option contract at 30, while they are trading lower in the market?

It is important to note that over the duration of an option, the underlying stock price can be quite volatile. Keep in mind that this will also influence the value of the option. Furthermore, it is possible that an option starts out ITM when the position is opened but that further down the road the option is ATM or OTM. The reverse is of course also possible.

Moneyness and expiration

The most important thing to remember when trading options is that options, which stil have intrinsic value at expiration, will automatically be executed. If u look at the amount of volume on option contracts at expiration you will notice that this is significantly higher than the volume a month earlier. It is thus possible that market makers push the stock price in a certain direction to drive options slightly OTM or ITM, whatever way they make the most money.

Once again it is crucial to keep in mind that only options that are ITM at expiration are meaningful. Furthermore, options that are ATM or OTM will be completely worthless at expiration.

Closing words

I really hope you enjoyed this article and now have a deeper understanding about the moneyness of options and intrinsic value. Our next article in this series will talk about extrinsic value and its components.

Feel free to send us a mail or contact us on twitter if u have any questions.

If u liked this article, u might want to check out our other articles as well. Check them out through the link below.