Atkore Inc. ($ATKR) An attractive prospect for the future of Green Energy and Infrastructure

"In the Spotlight" Atkore Inc.

In this “In The Spotlight” we will be discussing Atkore Inc. ($ATKR). This will be a special one as this article will be the first article that we will be writing with a good friend of ours. He is an indivual specialised in “Deep Value” Opportunities.

Intro

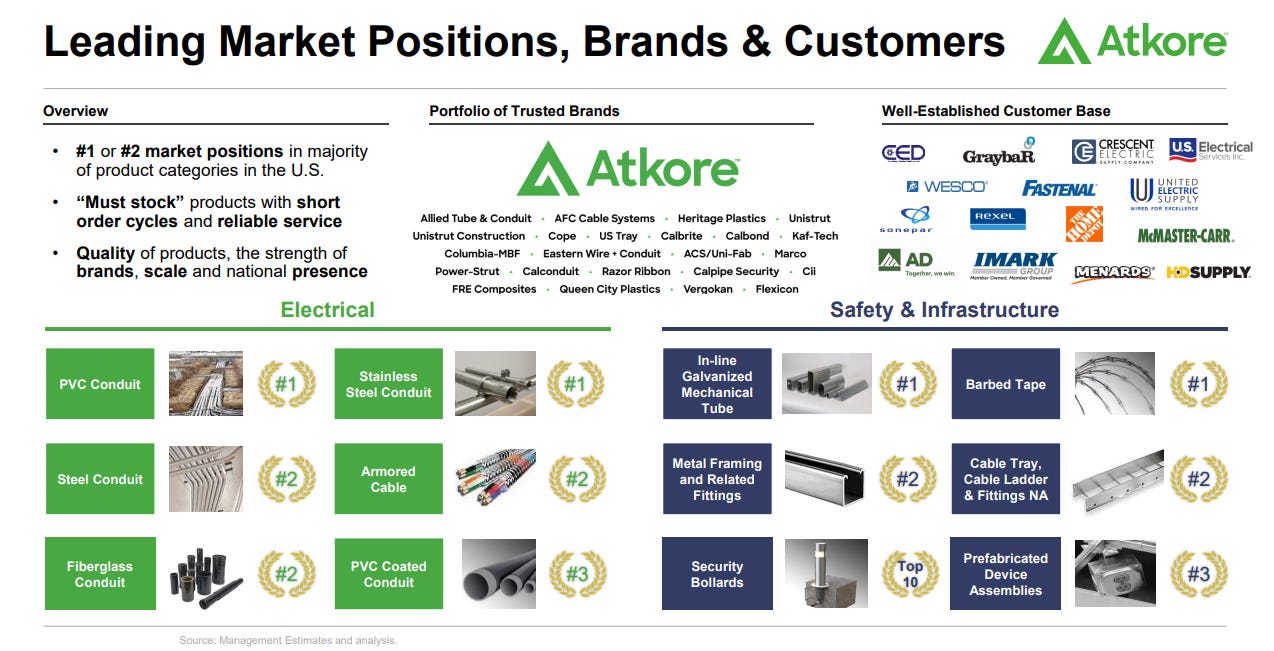

Atkore is a leading manufacturer of electrical products and safety products. Their product lines include electrical power systems, conduit, cable, installation accessories, metal framing, mechanical pipe, and perimeter security.

Atkore holds leading positions within the market. Most of their products are number 1 or 2 in their specific business.

Atkore supports its long-term growth by aggressively acquiring businesses, which helps with further product diversification.

Atkore has a strong economic moat

Continued investment in electrification of infrastructure and an increase in renewable energy infrastructure will benefit ATKR significantly.

In this article we will take a deep dive in ATKR and what we expect of the company in the upcoming years.

The Numbers

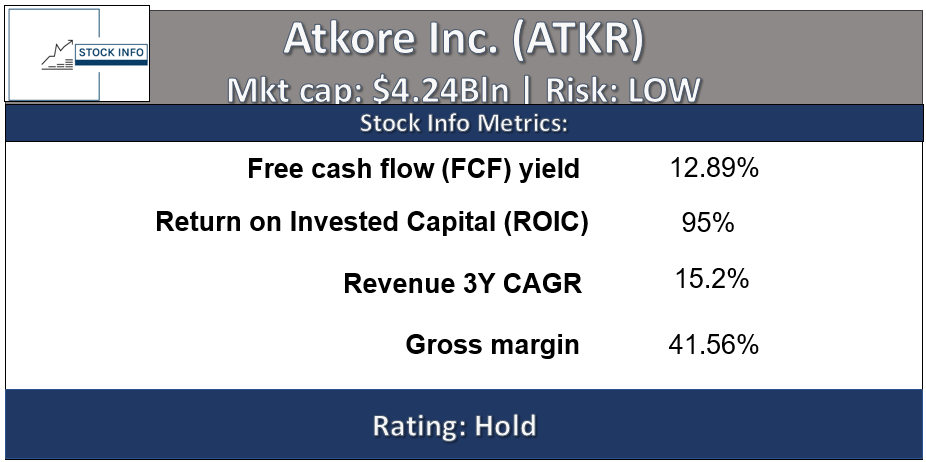

ATKR has a decent revenue 3-year annual growth rate of 15.2%.

ATKR has an impressive ROIC of 95%, indicating that each $100 invested in the business results in an additional $95 of operating income.

ATKR has an impressive gross margin of 41%, indicating that it has strong pricing power.

ATKR has a solid FCF of 12.89%, which indicates that the company could buy itself back in about 8 years.

Forward PE: At the current valuation ATKR has a forward PE of 4.19.

Split up into two segments

In 2021 they split their company into two segments to focus on growing the value of each segment individually and have kept with that model since.

As can be seen in the picture above the segments are broken up into:

Electrical Segment: Metal electrical conduit and fittings, plastic pipe and conduit, electrical cable and flexible conduit, and international cable management systems, which are critical components of the electrical infrastructure for new construction and maintenance, MR&R markets

Competitors in this segment: ABB Ltd., Eaton Corporation plc, nVent Electric plc, Hubbell Incorporated, Zekelman Industries, Inc., Nucor Corporation, Southwire Company, LLC, and Encore Wire Corporation plc

Safety and Infrastructure Segment: Mechanical pipe, metal framing and fittings, and perimeter security. Their metal framing products are used in the installation of electrical systems and various support structures, and their mechanical tube products can commonly be found in solar applications

Competitors in this segment: Zekelman Industries Inc., Eaton Corporation plc, ABB Ltd. and Haydon Corporation

Foreign Exchange Risk and Customer Diversification

Due to the massive changes in foreign exchange rates over the past couple of years, we figured it would be on your mind about how vulnerable this stock is to changes in these rates. Currently, this is more important than ever in a time when Morgan Stanley estimates at least 10% earnings decline in the S&P 500 due to exchange rate issues.

Furthermore, Atkore had an average of 89% costumer concentration in the United States in the 2019-2021, which indicates that there isn’t much foreign exchange risk. Unfortunately, there is still some risk involved. Especially due to the dollars havoc on the global economy. Almost every single foreign buyer that Atkore deals with has currency that has sunk against the dollar. In addition, on the foreign exchange front, all suppliers are in North America, as well as most manufacturing is done in the US. Taking all of this in consideration, there is more than likely no foreign exchange advantage to this business, and possibly minor impact due to small part of sales being dealt in other currencies.

Strategies and Economic Headwinds

According to their 2021 annual report (2022 ends this quarter so expect another annual report soon), they live and die by nonresidential construction. This also means that they live and die basically by United States GDP.

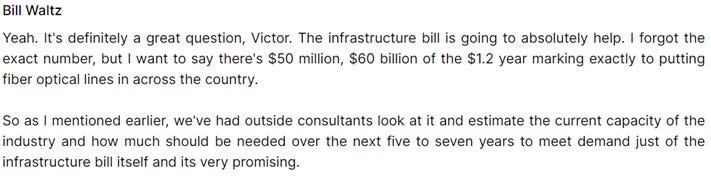

Now we might not be geniuses but, those 2 things sound like they are literally right around the corner so it sounds like Atkore might be up the creek without a paddle. The good news for us is, and let’s take a second look at that segments list again and we see that we are looking at a company who specializes in infrastructure, more specific, electric infrastructure. Now this sounds like something very similar to the “Inflation Reduction Act”, which has specific plans for electric infrastructure (how else are we supposed to support all those EVs that we can’t support). This is where we get some lucky news! Check out these comments from CEO Bill Waltz on the Q3 conference call:

Now this isn’t the clearest transcript of all time, but it sounds like our market leader in electric infrastructure and specifically fiber optic lines will have a great chance to capitalize on this “free money”. Furthermore, there is plenty of renewable energy infrastructure planning, which will lead to more spending in areas that they can capitalize on. In addition, this might stabilize some of the volume reduction and margin compression that should be expected leading into the future. The company stated in their Q3 report that they expect EIBTDA to decline from $1200-$1300 for 2022 to $800-$900 for 2023. Clearly management expects higher than that.

Valuation

Atkore originally popped up on our radar around the end of September (when it was in its early $70 range) and we just didn’t take the time to look into it until now, almost a month later, and boy was it a costly month. Meanwhile the stock has ballooned close to 25%. As a market leader and decent margin candidate we believe that it’s a pretty safe assumption (especially with currents management ability to allocate capital) to give a longer than usual time horizon with a decent amount of growth. We also took a look at the normalized earnings to accommodate for an expected margin crunch. This would give them a 2023 EBIT of around $450 million (this is a safe estimate). By normalizing their earnings and giving them a slightly above average growth rate. This can be justified due to further increase in expected demand over the decade.

In addition, the company has a great management team. We believe a multiple around 12-15 is reasonable. Furthermore, their stock buybacks for the rest of the year, will likely reduce the share amount towards 41.5 million shares. This gives an approximate intrinsic value of around $120-$131/s. We believe this to be a relatively conservative estimate but at the current share price it isn’t a 100 bagger by any means but we believe this to be a fairly decent investment deserving of a much higher than normal multiple.

Capital Allocation and Management

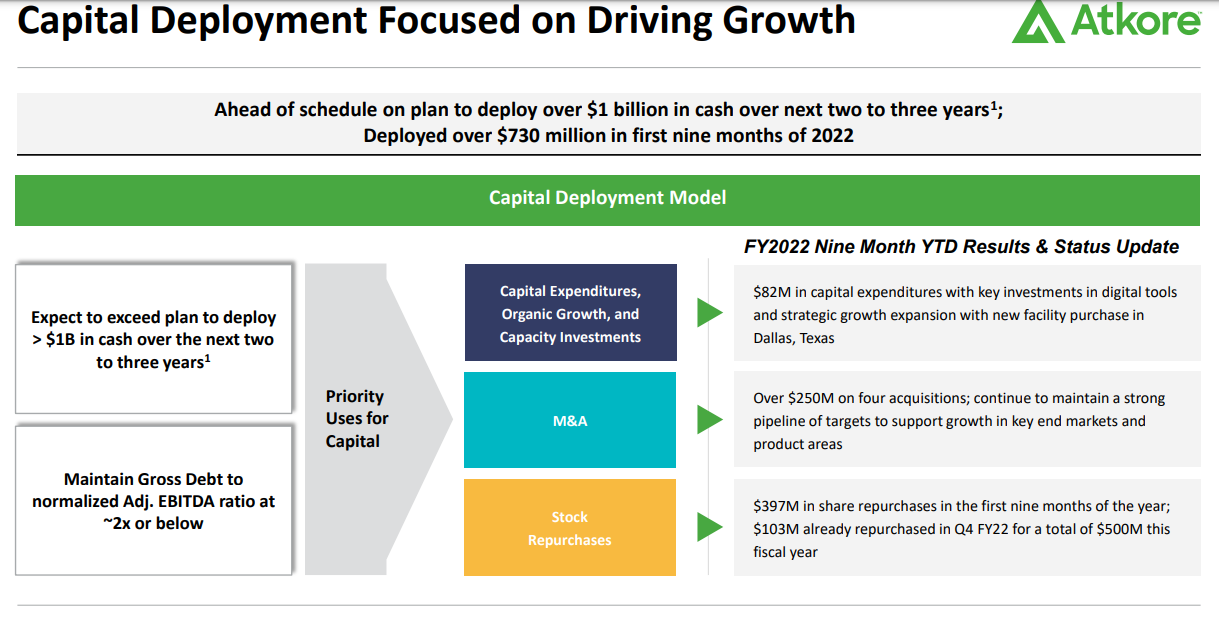

Atkore’s management has performed impeccably over the last 3 years. This is shown in their income statement over the last 3 years as well as a booming balance sheet due to a restructuring of loans in 2021 due to low interest rates and beautiful M&A allocation that is already paying for itself.

ROIC for 2021 and 2020 respectively was 95% and 46% (no small feat). In addition, a 10% increase in EBITDA from IPO (which was in 2016) until covid. Safe to say that this management and Bill Waltz know exactly what they’re doing, and we haven’t even gotten to the best news yet. There has been $500 million worth of share buybacks and we expect this to continue in the future. Furthermore, they plan to do over $1 billion in acquisitions ($250 million thus far) and share buybacks (over 25% of their current market cap!). In our opinion this sounds as a very exciting opportunity for a company that currently has a market cap of $3.76B.

“Mr. Waltz has served as the President and Chief Executive Officer of Atkore since 2018. Prior to that, he served in several other Company executive roles, including Chief Operating Officer and Group President of its electrical business. From 2009 until joining Atkore in 2013, Mr. Waltz was Chairman and Chief Executive Officer at Strategic Materials, Inc., North America’s largest glass recycling company.

Mr. Johnson joined Atkore in August 2018 with more than 29 years’ experience in strategic and financial planning, risk assessment, mergers & acquisitions, global tax strategies, international operations, and internal controls. Most recently, Mr. Johnson was Vice President-Finance & Operations for the Electrical Sector business at Eaton Corporation, where he was responsible for sector financial planning, analysis, and reporting; compliance, credit & collections, government accounting as well as global purchasing, manufacturing strategies, logistics and distribution.”

Insider Purchases:

Unfortunately, there haven’t been any insider purchases recently. We would like to see some insider action as this would further strengthen our thesis. As we know, insiders can sell for many reasons, but they only buy stock for one reason.

The Charts

As can be seen on the chart below ATKR currently has a YTD bottom around $70.52. This is an important support to watch. If the market continues to deteriorate, we could see the price drop below this level. This would mean more downside is possible.

We can see the stock is falling together with the market as itis currently down close to 30% since its ATH in June of this year, which is similar to the SPX. Currently, we are fighting the $89 resistance, which is getting rejected. Ideally, we would like to see the stock stay above the crucial $70.52 support. We believe the stock provides a very enticing opportunity around that $70 support level.

Now let’s have a look at the long-term chart. We can clearly see the stock is having a rough time. The stock has fallen close to 30% since its all-time high, as we mentioned above. As the company only IPO’d in 2016, we don’t have that much technical data yet.

Atkore does have a strong business as we discussed in this article. Atkore is well positioned in an industry, which will continue to grow in the future. Furthermore, the share buybacks will provide a cushion for the stock price in the next year. Although, the company will certainly struggle due to current macro-economic headwinds, we believe this company is one to keep an eye on for the long-term. We would like the stock to break above the current $89 resistance level, which has proven to be a tough nut to crack. If we break above, the $99 level seems likely.

Conclusion

We believe Atkore Inc. is a must watch if it declines further as we believe this company is well positioned to gain tremendously from further investments in infrastructure and green energy in the upcoming years.

We believe the share buybacks and further acquisitions will provide the stock price with a nice safety cushion. In addition, if management is able to continue their performance of the past, we believe ATKR is a rather safe investment with a lot of growth ahead.

Thanks for reading this in the Spotlight! Special thanks to our co-writer @Burryedge We will be doing more articles with other talented people soon. We hope you enjoyed it. Feel free to leave a comment below or contact us. Make sure to check out our twitter account by clicking HERE, that way you won’t miss out when we release a new article. Click here to check out our other articles HERE.

Disclosure: I/we have no stock, option or similar derivative position in the companies mentioned, and we have no intention to buy or sell within the next 72 hours.

I/we wrote this article ourselves, and it expresses our own opinion. I/we are not receiving compensation for it. This article shouldn’t be seen as investment advice as I/we are no financial advisors. I/we have no business relationship with any company whose stock is mentioned in this article.